About a decade ago—when my hips and knees were ten years younger—I fulfilled a bucket list goal of running a full marathon. At about mile nineteen, just when I was hitting the proverbial “wall,” the terrain went from relatively flat to mostly uphill for about two miles. While stifling an urge to curse the cruelty and sadism of the race organizers, I powered through and got to the top of the incline. Getting to the slightest downhill section felt like a sea change that propelled me to the finish line five miles later.

The automotive industry after covid has been running its version of a marathon, contending with numerous interrelated shocks to the system that began with the COVID-19 pandemic three and a half years ago. One consequence of these shocks has been an unrelenting march upward in average price, driven by short supply, sustained demand, parts shortages, and a focus on higher-end models and higher-contented trims. 2021, in particular, represented a sharp upward ascent—25.9% in one year and rising more than $1,000 every month from April to October, as inventories hit a low-water mark of 835,000 in September.

In 2022, as supply chain issues continued, OEMs focused production on models and trims that would best fill the profit gap left by diminished volumes. At that time, Cloud Theory pointed to the Full-Size Pickup Truck segment, which saw inventory priced above $55,000 jump from 17% in 2019 to more than half at the end of 2022 (and rise to two-thirds in Q1 2023). As a result, 2022—building on already highly elevated levels—saw an additional 5.5% rise in marketed prices.

2023 continued this relentless climb, with prices rising for ten months in a row (starting in late 2022) and hitting yet another all-time high ($52K) in the week ending July 30. So, when marketed values dropped slightly in the first week of August and then dropped again in the second, it feels like maybe we are reaching the top of the hill at mile 21. Even the most minor of declines—down 0.4% in the latest week vs. July—after such record highs seems momentous.

This sentiment needs to be tempered, however. I’ve been in the auto industry analytics game more than long enough to know that two weeks are not an inflection point, at least not yet. We will monitor these developments closely to determine if this price decline is just a temporary respite with another hill coming our way, but it doesn’t feel like that. With supply chain pressures continuing to ease, supply coming into better balance with demand, OEMs working to fill base and middle-level trim holes, and higher interest rates already putting pressure on consumers’ budgets, we very well may have reached the summit.

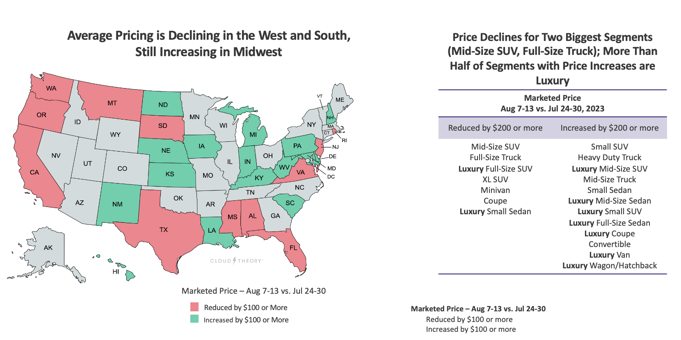

It is noted that some of the biggest states (California, Texas, Florida) and segments (Mid-Size SUVs, Full-Size Trucks) are leading the charge in these price declines. While there are other geographies (Midwest) and vehicle types (Luxury) that are acting as counterweights, it is likely that the larger ones will win out in the end.%20(2000%20x%201080%20px).png?width=708&height=382&name=Untitled%20(Presentation)%20(2000%20x%201080%20px).png)

In the meantime, the auto industry will continue to put one foot in front of the other as it runs its ongoing race.

.png?width=300&height=175&name=Untitled%20design%20(12).png)