At Cloud Theory, we dedicate significant time and resources toward tracking our proprietary and unique Inventory Efficiency Index metric. At a high level, the Inventory Efficiency Index is a great way to evaluate whether a manufacturer's make or model is getting a balanced share of vehicle movement relative to its inventory share in the marketplace.

Cloud Theory's Inventory Efficiency Index (IEI) assigns scores to vehicle makes based on current active inventory and sales data compared to competitors. A score of 100 means that relative supply and relative demand are balanced. A score above 100 indicates that a make or model is "punching above its weight" (i.e., it is selling its inventory more efficiently than average), while a score below 100 means that there are opportunities to bring demand into better alignment with supply (or vice versa).

Visualizing the IEI Difference

For OEMs, it can be beneficial to view how their makes or models rank on a national basis (“Who’s in the Top 10 this Month?”), but the real power of the Inventory Efficiency Index is its unique ability to narrow down the ranking of vehicle models by geographical region. Not only can IEI rank vehicles nationally, but it can specifically tailor results per region, state, and even city. This capability is what enables OEMs and automotive agencies to make intelligent decisions about marketing and incentive allocations. Namely, to spend more money where relative supply is outpacing relative demand.

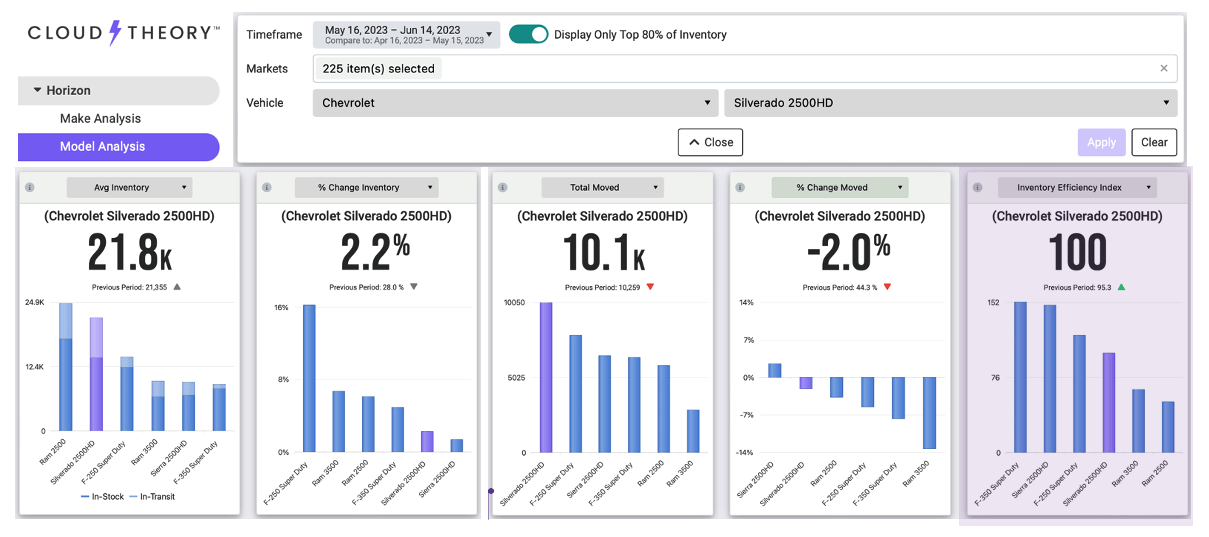

For a visual on the abilities of IEI, Cloud Theory found a model with an Inventory Efficiency Index score of exactly 100 over the last 30 days (through June 14, 2023) – the Chevrolet Silverado 2500HD within the Heavy-Duty Truck segment. With almost 22,000 vehicles in inventory and available to sell, it is well worth the time and attention to determine how it could and should be best supported.

If we view this model on a national basis, this vehicle is in balance between its supply and demand, but that is not the full story. While the Silverado 2500 is balanced across the total US, that is not the case when looking at a more granular geographical level. To get a full view of the capabilities of IEI, you need to dig deeper.

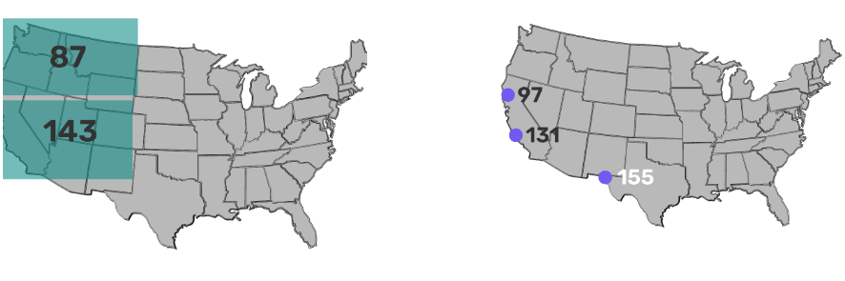

In the Western United States, Chevrolet Silverado 2500HD has an Inventory Efficiency Index of 129. At the same time, the Southeast region falls well below the 100 benchmarks, indicating that there is an opportunity to better align demand with supply.

But even in a region with strong efficiency, that view doesn’t tell the whole story. Here’s an example. In the Northwest, Silverado 2500HD is not nearly as efficient as in the Southwest. Even within the Southwest region, there are wide distinctions in efficiency between the El Paso, Los Angeles, and San Francisco DMAs.

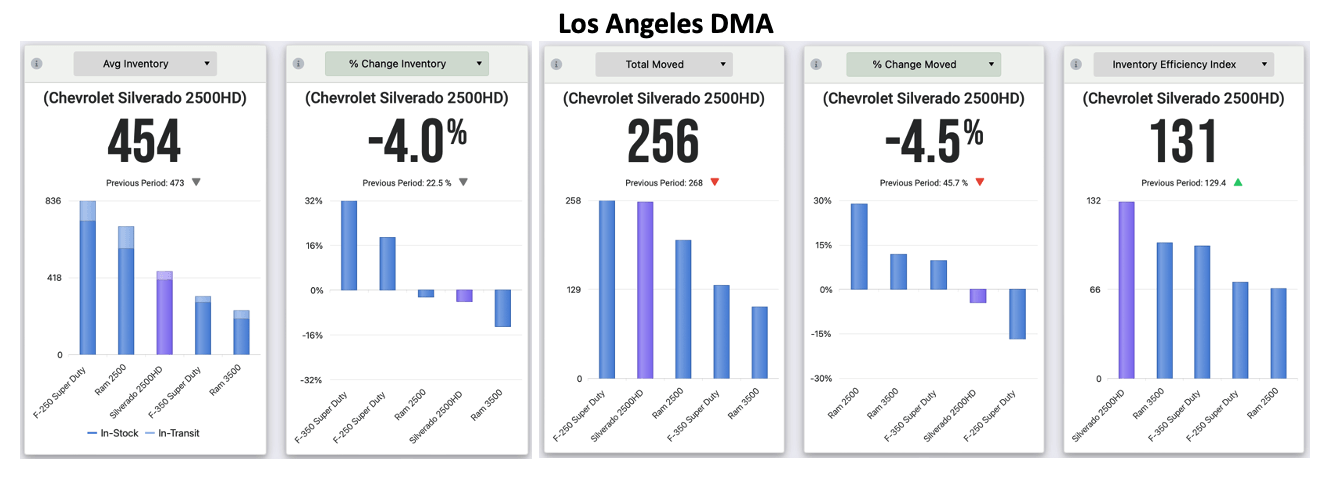

In the Los Angeles DMA, there are an average of 454 Chevrolet Silverado 2500HDs available (third highest of Heavy-Duty Trucks in that geography), and 56% of them sold in the latest 30-day period (256 out of 454). The Silverado had roughly half the level of supply compared to the Ford F-250, but sold almost the exact same number.

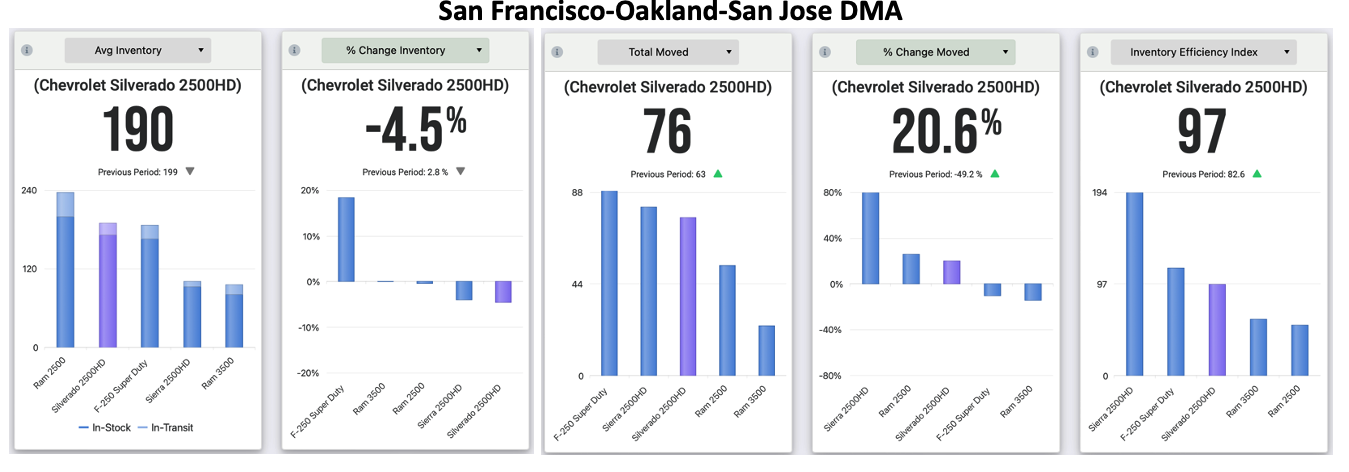

In the San Francisco-Oakland-San Jose DMA, on the other hand, only 40% of inventory (76 out of 190) moved in the latest 30-day period. It has the same amount of inventory as the Ford F-250 Super Duty but is being outsold by that competitor in this geography. It is noted that vehicle movement has positive momentum (+20.6%) upon which to build but has room to grow in terms of its efficiency score compared to its neighbor to the south.

OEMs know how much inventory they have and how fast it is selling but they are limited in the knowledge of their performance against their competitive set down to a market level in real-time. Knowing this information enables them to allocate (or reallocate) marketing or incentive dollars in areas of the country where demand is falling short of supply or to move supply to areas with greater demand.

“With the dynamics of the automotive marketplace continually changing, it is imperative that OEMs and their agency partners have granular and real-time information that enables them to put their money where it will work the hardest and have the most benefit,” said Ron Boe, Chief Revenue Officer at Cloud Theory. “Without it, money is spent to subsidize purchases that would have happened even in its absence, and opportunities to efficiently address sales shortfalls will be missed.”

Seeking the Latest Report? Discover Our Newest Resource Below: