Deep Discounting on 2023 Models Also Shifts Competitive Landscape

It’s no secret that the last four years have been unusual and unprecedented, both in the automotive industry and for the world at large. The long line of anomalous events is well documented—global pandemic, focused chip shortages followed by more general supply chain disruptions, rising interest rates, and rising EV supply coupled with waning demand are just some of the major narratives that have unfolded since 2020.

But a meaningful and significant industry event that has floated under the radar is the dynamic that is playing out in the Full-Size Truck segment over the past several weeks and months.

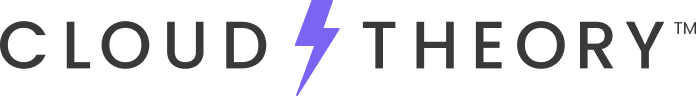

Ford F-150, the 800-pound gorilla of vehicles, saw its 2024 model year changeover delayed for more than two months due to production issues and quality checks. As a result, only 13.9% of F-150’s in-stock inventory is made up of 2024 model year vehicles. This is far below the competition, which ranges from 78% to 90%.

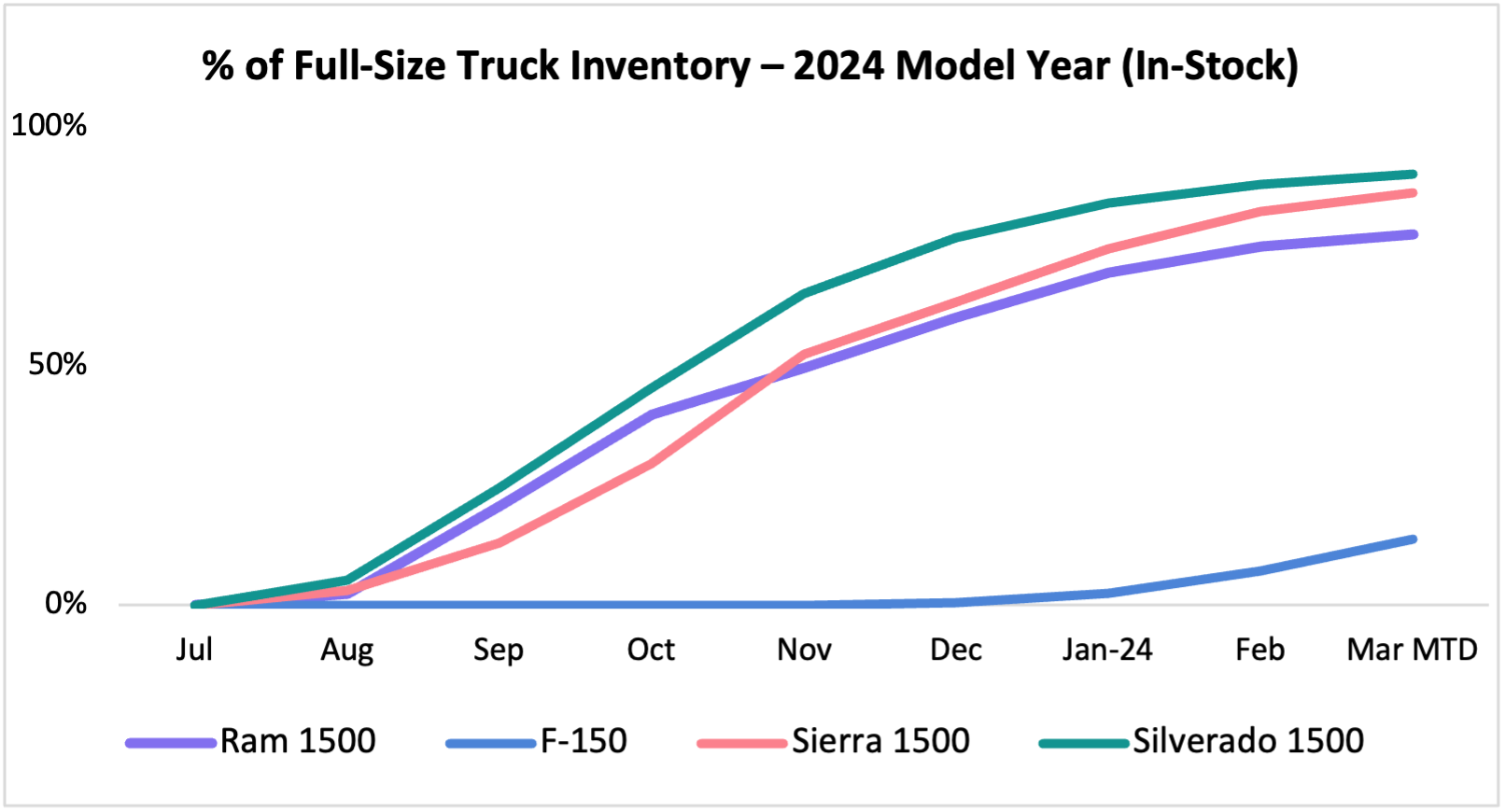

Meanwhile, the number of 2023 F-150s on dealer lots averaged 71,525 in March 2024, indicating that the model year changeover is just getting started. To clear out that inventory, dealers have been enacting deep discounts that are disrupting the normal competitive dynamics in the segment. Moved price—a metric that reflects the last marketed price on a dealer’s website before a vehicle is sold—dropped from a level consistently above $62,000 until November to $59,000 currently, and aggressive incentive discounts have also been made available.

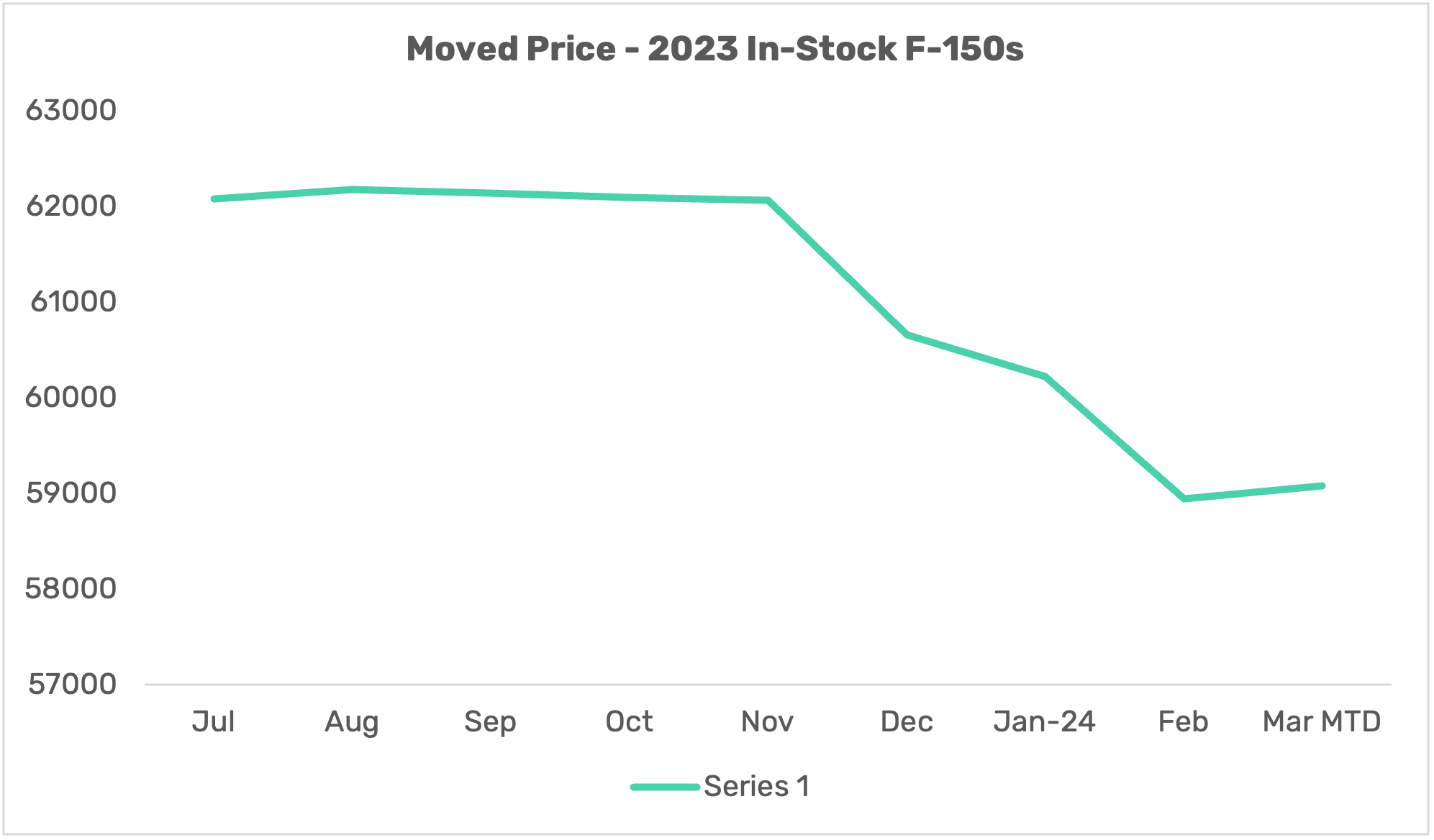

As a result, F-150’s market share has remained relatively flat (-0.12 points) despite losing 3.77 points of inventory share over the past 30 days. The competitive shifts are mixed to say the least. Chevrolet Silverado 1500 has benefitted from F-150’s short supply—gaining two-and-a-half points of market share—while Ram 1500’s market share has been negatively affected by Ford’s reduced pricing. Sierra 1500 is seeing a small market share decline despite gaining more than a point of inventory share.

The Full-Size Truck segment, usually the embodiment of consistency and stability, has been thrown for a loop. And the glut of 2023 F-150s still available and being marketed to consumers indicates that this situation will continue to develop as the calendar page turns from March to April.

These shifts indicate just one more marketplace disruption in what’s been a long line of them these past four years.